25% Off Microsoft Excel - Managing Personal Finances with Excel | Udemy Review & Coupon

25% Off Microsoft Excel - Managing Personal Finances with Excel | Udemy Review & Coupon

Couldn't load pickup availability

Start a Plan to Gain Financial Awareness and Confidence by Creating a Personal Finance Template with Microsoft Excel

This course covers:

This course offers comprehensive training on a given subject matter. Upon completion, it provides learners with a certificate of completion and full lifetime access. The course is packed with 3 hours of on-demand video as well as 2 downloadable resources for further study. In addition to viewing the content on a computer or tablet, the course can also be accessed via mobile devices and TVs.

The combination of 3 hours video, followed by downloadable solutions and then ending with full lifetime access really makes this course unlike any other. Students get ample time to watch paced videos, practice their new skills, learn from professionals, access complete material anytime without having to worry about expiration dates etc., and finally get certified upon completion of their training program. A flexible approach from start to finish makes it possible for interested learners to make great progress on their own time and terms!

What you'll learn

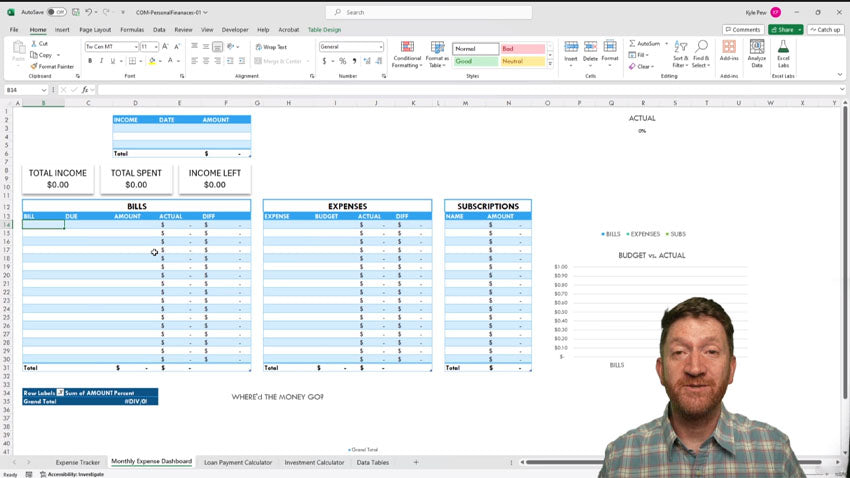

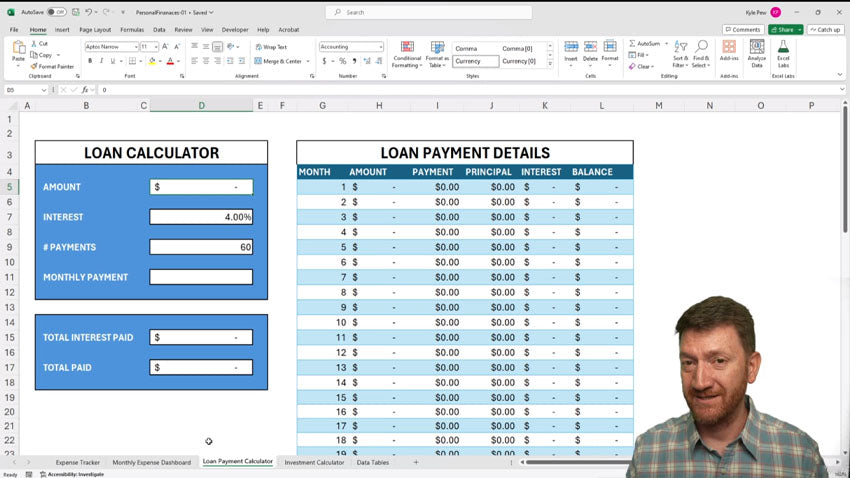

Learning how to manage your personal finances is an important part of life. With the help of Microsoft Excel, you can create a customized monthly budget template that allows you to easily track and identify where your money is being spent. By using key Excel visuals, such as charts and graphs, you can make informed decisions about how to best allocate your funds. Additionally, Excel enables you to set savings goals within your budget through its powerful dynamic tools.

Using Microsoft Excel for personal finance management gives you the ability to easily make adjustments or updates whenever necessary. All changes are automatically calculated and displayed within the spreadsheet so that you are always up-to-date with exactly where your money is going. This makes it easier than ever to stay on top of your finances and keep them in order without having to manually calculate any figures yourself. Overall, utilizing Microsoft Excel to manage personal finances is an invaluable tool which can help bring more control and transparency into your financial life.

Description

When I was younger, it felt like all of my money disappeared just as soon as I got paid. Thinking back on it now, I realize that the blame can be attributed to my lack of financial responsibility. My mom always said that I had a hole in my pocket— referring to how quickly my money would drain away. After cashing in my hard-earned paycheck from my after-school job, the cash would be gone soon enough without me even realizing where it had gone.

Surprisingly though, this wasn't necessarily due to me splurging and treating myself to what I wanted. It was more an unconscious thing; spending here-and-there in small doses until all of a sudden I'd find myself out of money before payday hit again. To this day, the saying “a hole in my pocket” always brings back waves of nostalgia and guilt for past mistakes. Do you ever recall having that same feeling as a kid?

The good news is that I eventually figured out how to tackle this problem. After doing some research and talking to people wiser than myself, I came to the conclusion that Microsoft Excel could be my savior! This amazing software provides a powerful platform for managing personal finances. With the right tools, one can easily create their own budgeting templates that ensure they stay on top of their spending.

This course is intended for:

This course is aimed at people looking to improve their efficiency and maximize their productivity when it comes to personal finance management in Microsoft Excel. People who attend will learn how to utilize the tools available in Excel for their personal finances, such as budgeting, tracking expenses, creating graphs and charts, generating reports, and forecasting trends. The course will cover advanced features such as linking cells or merging worksheets together which will be extremely useful for keeping up-to-date with financial trackers or tracking investments over time. It also covers simple concepts such as setting up a basic spreadsheet to get started with your finances.

This training course is designed to benefit novice-level users but can also be beneficial for intermediate users who want to dig deeper into the capabilities of Excel for personal finance management. Those attending this course can gain access to organized tutorials on formulas, functions, tools built within excel so they are able to keep all their information in one place. By the end of the class attendees will know how to create helpful visuals that give quick insight into their financial data which should help them build well informed decisions when managing their finances.

Share: